White Label Dealer: A Complete Guide To Forex White Label Dealer Solutions

Liquidity providers for foreign exchange brokers play an important position in financial markets and exchanges to make sure a seamless execution of trades. The liquidity provider you select tremendously impacts the product offerings and trading setting that you can present your shoppers. Shopper Relationship Management (CRM) Software Program The subsequent key software program for any Dealer is a CRM to handle shopper accounts. A highly effective CRM is indispensable for forex brokers in terms of enhanced buyer administration and end-user experiences.

Foreign Exchange Investigations And The Future Of The International Trade Market: What To Expect

As the expiration date approaches, the option will lose time value and be worthless. The strike worth of the option may even affect its value if the strike value is out of the money, thus leaving the choice with less intrinsic value. When you commerce options, you have the selection between a name possibility and a put option. There isn’t any need to spend time on the combination of a third-party platform or spend money to buy further licenses.

Bid And Ask Price Explained: What’s The Distinction In Trading?

One-click trading and alerts are another useful features of the platform on Turnkey Forex. If you don’t mind the dearth of schooling and academic resources, you can see this no-nonsense broker highly useful, practical, and suitable with a variety of methods. Total, should you Turnkey Forex Solutions want entry to one of many world’s most popular trading platforms and low costs, this can be the dealer you want.

With so many concerns, it is not only expensive but advanced to design an effective CRM and to house a dedicated team to constantly improve and update it. Reliable providers offer turnkey options, however success isn’t guaranteed and requires hard work, funding, and persistence. White-label FX platforms will must have back-office options which are crucial for environment friendly operational administration. These options help numerous aspects, guaranteeing client and regulatory needs are met. These embrace shopper account administration, which involves overseeing account registrations, verifying shopper identities, and managing account settings. Customised alerts may be set for worth thresholds, financial events, or market situations.

What Do You Should Learn About Foreign Exchange Brokerage Threat Administration To Become Almost Bulletproof

- The strike worth of the option may even affect its value if the strike price is out of the money, thus leaving the choice with much less intrinsic worth.

- Basically, the white label resolution provider supplies the software program and plugins needed to start a dealer, while the founders of the broker give attention to the operations, advertising and shopper acquisition.

- The preliminary investment for a white-label forex brokerage can vary considerably, depending in your jurisdiction, enterprise model, and white-label supplier.

- Some reputed licenses embody Cyprus Securities and Change Commission (CySEC), Vanuatu Financial Providers Fee (VFSC), and UK’s Financial Conduct Authority (FCA).

Whereas you’ll nonetheless need some growth sources to customise and combine your answer, the core platform is already constructed, tested, and prepared for branding and tailoring. No matter the buying and selling account varieties you supply, crucial think about your brokerage’s success is offering fully customisable deposit and withdrawal options. When it involves Forex, you are little doubt aware of how sturdy the MT4 and MT5 buying and selling platforms are. You are no doubt aware of the truth that ranging from scratch as a broker has vital upfront costs, countless growth wants plus all the small bits and items wanted to complete the ‘puzzle’. By far the biggest good factor about starting your own forex business is removing all the complexity and exorbitant prices of going it alone.

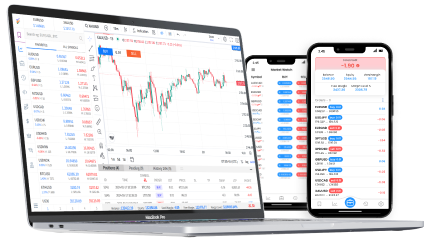

All platforms support multi-asset buying and selling (forex, crypto, indices, commodities) and full front-end customization. We guarantee your brokerage launches successfully and scales effectively with comprehensive testing, coaching, and advertising support. We handle the advanced financial infrastructure including fee processing, banking relationships, and compliance systems so you’ll find a way to focus on development. Built-in MiFID II and ESMA compliance tools together with adverse steadiness safety, leverage limits, and automated reporting for regulatory audits. Real-time leverage management system that mechanically adjusts consumer leverage based on account fairness, trading volume, and market circumstances to forestall extreme publicity. The industry-standard MT4 Trading Platform with superior charting, EAs, and full white label solution.

Utilizing a white-label foreign exchange answer, then again, can drastically reduce these startup costs, permitting you to launch your small business quicker and rather more affordably. Retail trading within the forex markets demands pace and efficiency in terms of funding accounts. A seamless consumer experience ensures traders can deposit funds effortlessly and withdraw profits without unnecessary delays. Full compatibility with MT4, MT5, cTrader, Match-Trader, DXtrade with API access for custom liquidity suppliers. Our Foreign Exchange CRM with Again Office supplies a comprehensive Foreign Exchange Dealer Turnkey Answer that permits brokers to effectively handle the whole client lifecycle from onboarding to ongoing account management. With features like KYC Verification Foreign Exchange, Foreign Exchange Pockets System, and IB Commission Construction, it is the perfect Dealer Again Office Answer for each new and established brokers.